Company Retirement Plan Management that Enables Employees to Thrive

At Silver Anchor Financial, we partner with companies to deliver customized Qualified Retirement Solutions that effectively balance the mitigation and management of fiduciary responsibilities with a benefit that will attract and retain top talent and foster a culture of financial well-being.

John’s expertise in Qualified Retirement Plans, including 401(k), Profit Sharing, and Cash Balance Plans, sets Silver Anchor Financial apart. His approach is unique because he serves as the point of contact for each client relationship from prospect to plan manager. John assists Plan Sponsors through the setup and implementation process and continues to service the plan on an ongoing basis. He manages Plan Sponsor expectations and provides education and guidance to every eligible participant.

Several features distinguish John’s retirement plans and align the interests of all parties:

- Open architecture recordkeeping and custodian platforms ensure flexibility and transparency.

- ERISA 3(21) and 3(38) fiduciary services share and manage the fiduciary responsibilities of the plans.

- Fee-based retirement plan offerings focus on solutions rather than commission-based products, ensuring that clients receive unbiased advice and the best possible outcomes.

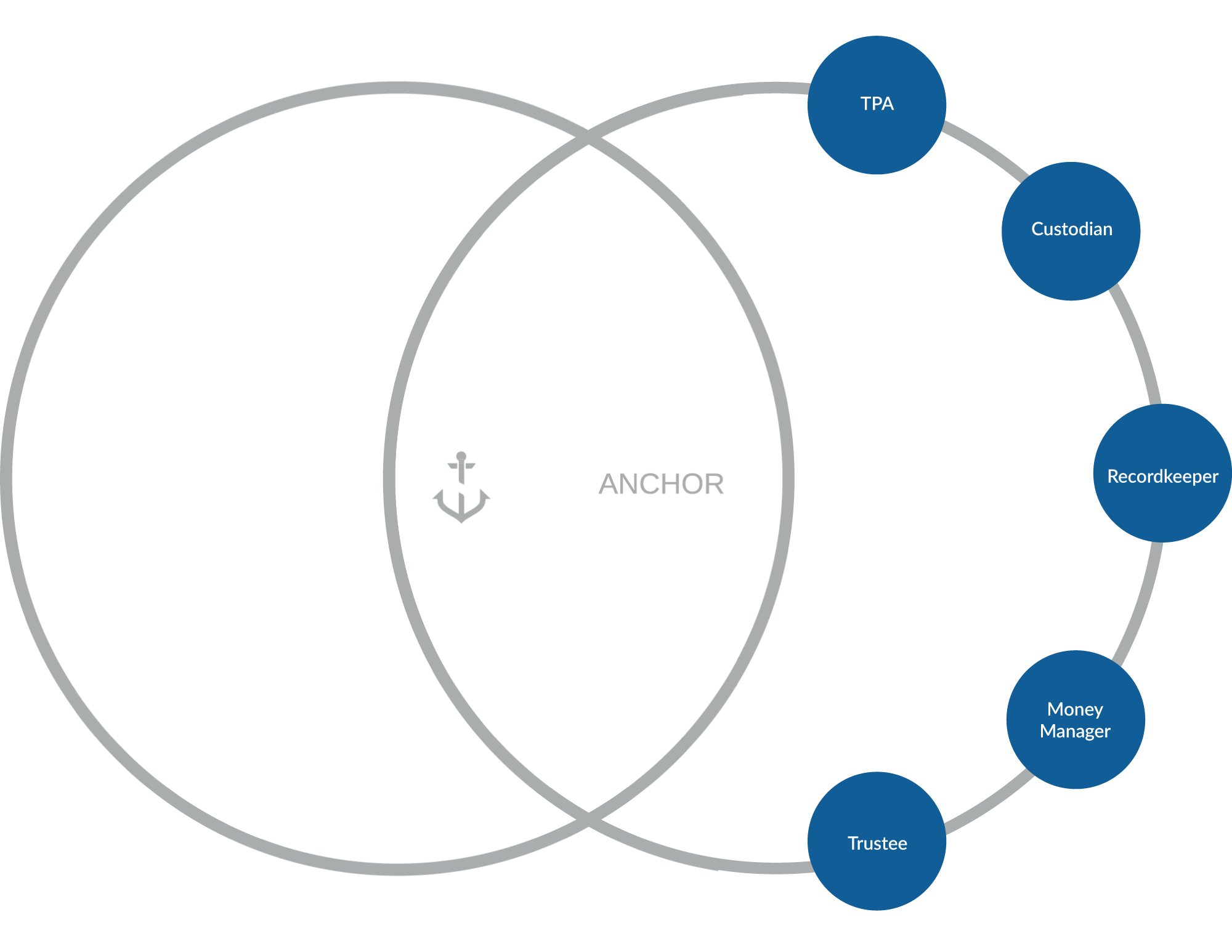

We Live at the Center

of Your Company's Retirement Plan Solution

Silver Anchor Helps You Mitigate and Manage Your Fiduciary Responsibilities.

When it Comes to Designing and Delivering a Comprehensive Analysis For 401(K) Qualified Retirement Plans, We Check All of the Boxes.

-

Plan Design

Rewards philosophy, retirement sufficiency analysis, assessment of employer costs, expected employee behaviors,

-

Plan Benefits

Match (tiered or not), non-elective, combination, integrated, cross-tested, etc.

-

Plan Features

Match (tiered or not), non-elective, combination, integrated, cross-tested, etc.

-

Plan Administration

Recordkeeper competency, services, service agreement and fees, confirm if any tasks should be in-sourced, out-sourced, or co-sourced

-

Compliance

Document review, Summary Plan Description (SPD), error-evaluation and correction (self-correction, VCP)

-

Investment Structure

Compare current lineup to best practices

-

Selection

Investment Manager Review and Selection

-

Total Plan Expense Analysis

Employer-paid vs. employee-paid; benchmark to peer group

-

Communication and Education

Effectiveness of current approach/media

-

Benchmark Findings

Third-Party studies relative to appropriate peer group and industry best practices